What Are Some Reliable NRI Investment Options in India?

As Non-Resident Indians (NRIs), investing in our homeland can be a rewarding way to contribute to its growth while maximizing our returns. Let's explore some reliable investment avenues available through NRI Services, along with their benefits and considerations.

Understanding NRI Investments

NRI investments refer to the financial assets and instruments that NRIs can invest in while residing abroad. These investments offer opportunities to grow wealth, generate income, and achieve long-term financial goals while maintaining ties with India.

Avenues of NRI Investments

1. Equities

NRIs can directly invest in Indian equities through the Portfolio Investment Scheme (PIS) route provided by the Reserve Bank of India (RBI). This allows NRIs to participate in the Indian stock market and potentially benefit from its growth opportunities.

2. Mutual Funds

NRIs can invest in various categories of Mutual Funds, including Equity, Balanced, Bond, and Liquid Funds. Unlike direct equities, investment in Mutual Funds does not require PIS permission from RBI, making it a convenient option for NRIs.

3. Government Securities

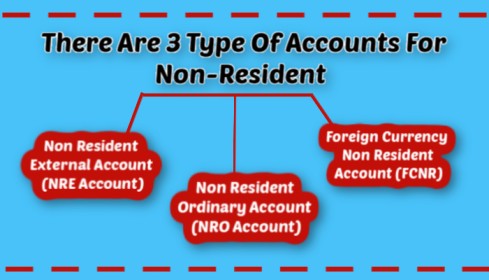

NRIs can invest in government securities on either a Non-Resident External (NRE) or Non-Resident Ordinary (NRO) basis. Interest on NRE investments is tax-exempt, while interest on NRO investments is taxable.

4. Fixed Deposits

NRIs can invest in fixed deposits offered by Banks or Non-Banking Financial Companies (NBFCs) on either an NRE or NRO basis. Interest on NRO deposits is taxable, while interest on NRE deposits is tax-exempt.

5. Real Estate

NRIs can also purchase both residential and commercial properties in India. However, agricultural land, farmland, or plantations are not allowed to be purchased. NRIs can receive these properties through inheritance or gift.

6. National Pension Scheme (NPS)

NPS is a government-backed retirement savings plan with tax benefits. Contributions and accrued capital gains are tax-exempt, while withdrawals are subject to tax. NRIs can contribute to NPS from their NRE or NRO accounts, but the pension must be received in India.

Benefits of NRI Investments

- Diversification: Investing in India provides NRIs with diversification benefits by allocating their assets across different markets and asset classes.

- Potential Returns: Indian markets offer growth potential and investment opportunities that can potentially yield attractive returns over the long term.a

- Tax Efficiency: Certain investment options, such as NRE deposits and NPS contributions, offer tax benefits to NRIs, helping them optimize their tax liabilities.

- Real Estate Opportunities: Investing in Indian real estate allows NRIs to own property in their homeland and potentially benefit from capital appreciation.

Conclusion

Now that you know about reliable NRI investment options in India, whether it's equities, mutual funds, government securities, or real estate, each investment avenue offers its own set of benefits and considerations, by analysing your investment goals, comfort level with risk, and tax implications, you can make well-informed decisions.

.jpg)

Comments

Post a Comment