What are NRI Investment Options in India?

Imagine this: you've built a successful life abroad, but a piece of your heart remains in India. You yearn to connect with your roots, contribute to the nation's growth, and secure a brighter future for yourself and your loved ones back home. This is where NRI investment in India comes in, offering a bridge between your global journey and your Indian heritage.

As an NRI, navigating the investment landscape in India

can seem daunting. But worry not! With the right guidance and a plethora of

attractive options, you can embark on a fulfilling investment journey in the

land of your origin.

Samarth Capital, your trusted partner for NRI services,

is here to illuminate your path. We understand your unique needs and

aspirations, and we're committed to providing comprehensive support every step

of the way.

Let's explore the diverse avenues for investment in

India:

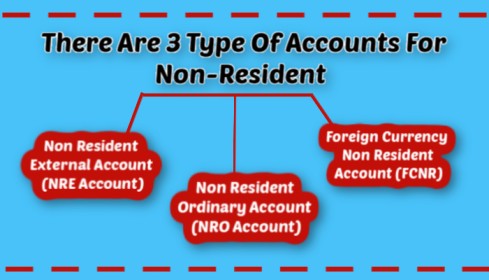

1. Fixed Deposits (FDs): Seeking stability and guaranteed returns? FDs offer a

safe haven for your investments. Choose from NRE (Non-Resident External)

accounts for foreign earnings or NRO (Non-Resident Ordinary) accounts for

Indian income. Both options provide attractive interest rates and tax benefits

under certain conditions.

2. Mutual Funds: For those seeking diversification and professional

management, mutual funds are an excellent choice. Invest in a variety of

equity, debt, or hybrid funds based on your risk appetite and financial goals.

Remember, mutual funds involve market risks, so careful research and expert

guidance are crucial.

3. Indian Stock Market: Experienced investors with a high-risk tolerance can

explore the Indian stock market through the Portfolio Investment Scheme (PIS).

Invest directly in shares or opt for Exchange Traded Funds (ETFs) for broader

market exposure. Remember, stock market investments are subject to significant

volatility, so proceed with caution and a clear understanding of the risks

involved.

Unlocking the Potential: How Samarth Capital Can Assist

You

If you want to access the Indian stock market, it is

crucial to know how to open

NRI demat account. Samarth Capital's team can simplify this process,

guiding you through the documentation and regulations. We also offer

personalized investment advice, portfolio management, and tax planning

assistance to ensure your journey is smooth and successful.

.jpg)

Comments

Post a Comment