What are the Ways NRIs Can Invest in India?

Many Non-resident Indians (NRIs) might

not know that they can jump into the exciting Indian market. It's not just

about mutual funds - there are more ways for NRIs to start investing in India

and make their money work in their home country, opening doors to more

financial possibilities and security.

Ways NRIs Can Invest in India

1.

Equities: NRIs can directly invest in Indian equities

through the Portfolio Investment Scheme (PIS) route sanctioned by the Reserve

Bank of India (RBI). This avenue offers a direct stake in the growth and

performance of Indian companies, providing a comprehensive investment

experience.

2.

Mutual Funds: A versatile choice, Mutual Funds offer

NRIs access to various categories such as Equity, Balanced, Bond, and Liquid

Funds. Unlike direct equities, Mutual Fund investments do not necessitate PIS

permission from the RBI. However, it's crucial to note that certain limitations

apply to US and Canada-based NRIs due to reporting requirements under FATCA/CRS

rules.

3.

Government Securities: NRIs can venture into

government securities on an NRE or NRO basis. While interest on NRE investments

remains tax-exempt, NRO investments attract taxable interest, subject to

withholding tax (TDS).

4.

Fixed Deposits: Investing in fixed deposits of banks

or Non-Banking Financial Companies (NBFCs) is another avenue for NRIs.

Depending on the terms of the issue, investments can be made on both NRE and

NRO bases. Interest on NRO deposits is taxable with TDS implications, whereas

interest on NRE deposits remains tax-exempt.

5.

Real Estate: NRIs have the opportunity to invest in

residential and commercial properties in India. However, certain restrictions

apply, barring the acquisition of agricultural land, farmland, or plantations.

These restrictions don't extend to inheritance or gifts, offering flexibility

in property ownership.

6.

National Pension Scheme (NPS): A government-backed

retirement savings plan, NPS operates under the EET tax structure

(Exempt-Exempt-Tax). Contributions and accrued capital gains enjoy tax

exemption, while withdrawals are subject to taxation. This cost-effective

scheme is an ideal choice for NRIs planning to spend their retired life in

India. Contributions to NPS can be made from NRE or NRO accounts, but the

pension must be received in India and is non-repatriable.

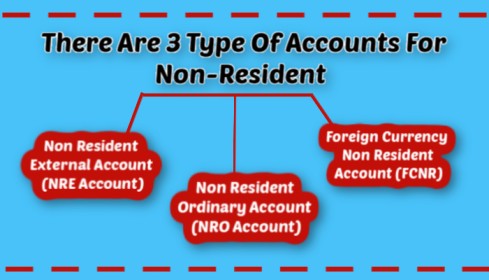

Types of Accounts For NRIs

- NRE (Non-Resident External) Account:

○

For NRIs to park foreign income in

India.

○

Fully repatriable, allowing funds

to be taken back abroad.

○

Ideal for seamless international

transactions.

- NRO

(Non-Resident Ordinary) Account:

○

For managing income earned in

India.

○

Partially repatriable, with

certain conditions.

○

Useful for local transactions and

bill payments.

- FCNR

(Foreign Currency Non-Resident) Account:

○

Maintained in foreign currencies

to curb exchange rate risks.

○

Fully repatriable, ensuring

flexibility in moving funds.

○

Suitable for NRIs looking to

retain foreign currency holdings.

Conclusion

As NRIs consider their investment journey

in India, Samarth Capital offers a diverse range of options from equities and Mutual

Funds in India to real estate and more. NRIs can not only invest in

India but also foster financial growth and security for the long term in their

homeland.

.jpg)

Comments

Post a Comment