How Can NRIs Invest in India With NRI Services?

Non-resident Indians (NRIs) hold a unique position in the Indian economy. They are not only a valuable source of foreign exchange, but also a potential force driving the country's growth story. Navigating investments in India can be a bit confusing for NRIs. Understanding where and how to invest amidst regulations, tax implications, and diverse options can feel tricky, which is why, NRIs willing to invest in India can rely on NRI services, which make investing easier as per the rules set by RBI and SEBI under the Foreign Exchange Management Act (FEMA).

Where Can NRIs Invest in India?

NRI services encompass a range of financial solutions tailored specifically for non-resident Indians seeking to invest, manage their wealth, and connect with their homeland. It is vital to understand where NRIs can invest in India.

Equities

NRIs can invest directly in Indian stocks through the Portfolio Investment Scheme (PIS) by the Reserve Bank of India (RBI).

Mutual Funds

Investing in Mutual Funds offers various choices like Equity, Balanced, Bond, and Liquid Funds. Unlike direct equities, NRIs investing in Mutual Funds do not require PIS permissions from RBI. However, some restrictions may apply to NRIs from the US and Canada due to reporting regulations.

Government Securities

NRIs can invest in government securities on NRE and NRO basis, each with different tax implications based on the type of investment.

Fixed Deposits

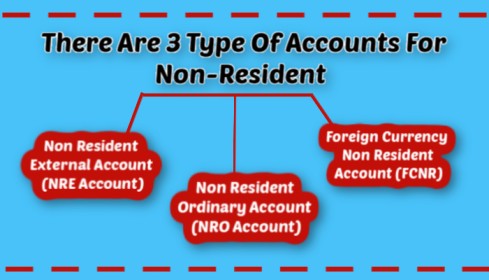

Investment opportunities in fixed deposits are available for NRIs through Banks or Non-Banking Financial Companies (NBFCs), each with its tax implications based on the NRE (Non-Resident External) or NRO (Non-Resident Ordinary) basis. NRIs can also invest in Foreign Currency Non-Resident (FCNR) fixed deposits.

Real Estate

NRIs can invest in real estate except for certain property types like agricultural land, farmland, or plantations.

National Pension Scheme (NPS)

NPS, a retirement savings plan, offers tax benefits. Contributions can be made from NRE or NRO accounts, but the pension must be received in India.

Portfolio Investment Scheme (PIS)

PIS allows NRIs to trade in shares and debentures through a designated bank account. It helps regulate NRI holdings in Indian companies, preventing breaches of set limits.

How Experts Simplify NRI Services?

Experts like Samarth Capital simplify the investment process by providing guidance, ensuring NRIs make informed decisions aligned with their goals. Here’s how they make investing easy for NRIs.

- Helping open NRE / NRO savings and PIS bank accounts.

- Setting up brokerage and demat accounts for trade.

- Monitoring your portfolio regularly.

- Engaging tax consultants for compliance.

Understanding Taxes and Rules

For NRIs, it's crucial to understand tax implications in India and their country of residence. Compliance with the Double Tax Avoidance Agreement (DTAA) and filing taxes in India if taxable income exceeds the exemption limit is important.

Wrapping Up

Investing in India as an NRI offers diverse opportunities. With guidance and a grasp of regulations, NRIs can navigate this landscape effectively and make the most of available avenues. Samarth Capital, not only facilitates NRI investments but also helps foreigners invest in India with FPI services. So, whether you're an NRI or a foreigner, investment in India isn't a far-fetched dream anymore.

.jpg)

Comments

Post a Comment